KFP Market View in August 2021

GLOBAL ECONOMY

The China Investment Conundrum

As will be apparent to all readers, China has started to flex its political and economic muscles in a significant way over the past few years based on its perceived and real economic strength.

As of December 2020, China’s GDP was calculated by the World Bank at $14.7trillion (13.0% of global GDP), vs $20.9trillion (18.6%) for the USA. Equity market capitalisation in the US stands at approx. $50trillion, vs $11trillion for China (ex Hong Kong). China’s economic growth continues to impress, with the latest year on year growth to June 30th set at 7.9%. Based on these metrics, China cannot be ignored from a global investment perspective and increasing investment flows have been seen into both equity and fixed income markets over the past few years.

Nevertheless, over the past year starting with the last-minute failure of Ant Financial’s IPO in November 2020 due to regulatory issues, Chinese market regulators have been disrupting the market for Chinese stocks with a variety of controlling measures. This has seen the listed China Tech equity market sector lose $1.2trillion in value (per Goldman Sachs) since the start of this year. The latest swipe has been at the private education business (tutoring), with proposals that they should be run as not-for-profit enterprises, as opposed to profit driven enterprises. $16bn has been wiped off the market capitalisation of the largest three businesses listed in the US, with TAL Education (the largest tutoring business in China with 45,000 employees) losing 93% on the price of its ADR. Overall, the China CSI 300 index lost -6.3% in the week the new measures were announced and is down -7.7% year to date. Other market sectors are believed to be in the aim of regulators – in particular, pharmaceuticals and essential consumer goods.

Much of the capital raised for these companies has been in the US market through ADR’s on instruments known as Variable Interest Entities (VIE) which provide economic exposure but not legal ownership of equity in Chinese companies, and therefore with limited investor protection compared to western expectations. The recent events are likely to preclude further capital raising by Chinese companies in the US markets for the foreseeable future, essentially forcing Chinese companies to raise capital domestically, or through Hong Kong for international investors. This may indeed be part of China’s game plan.

Clearly these events have unsettled markets and foreign investors in China, who will be looking for stability and certainty for their investments. China however has other priorities, summarised again by GS as “the Chinese authorities are prioritizing social welfare and wealth redistribution over capital markets (…) consistent with their repeated emphasis of promoting fair growth and “broad prosperity” since late last year.”

For international investors, the message is clear: “It’s hard to know what you’re getting into with Chinese assets. And between the current Chinese regime’s laser-sharp focus on political control and its intention to control financial risks, more shocks are likely to come.” (Bloomberg). The China political risk is now clearer than ever for investors.

The conundrum for investors is (and always has been) how to take advantage of the growth opportunities in China, while understanding (and minimising) the economic and political risks associated with the investing in China – whether in public or private markets.

Portfolio allocation limits and proper diversification are essential to controlling some of these risks, with thorough due diligence on company specific risks.

Growth Rate Slowdown in evidence

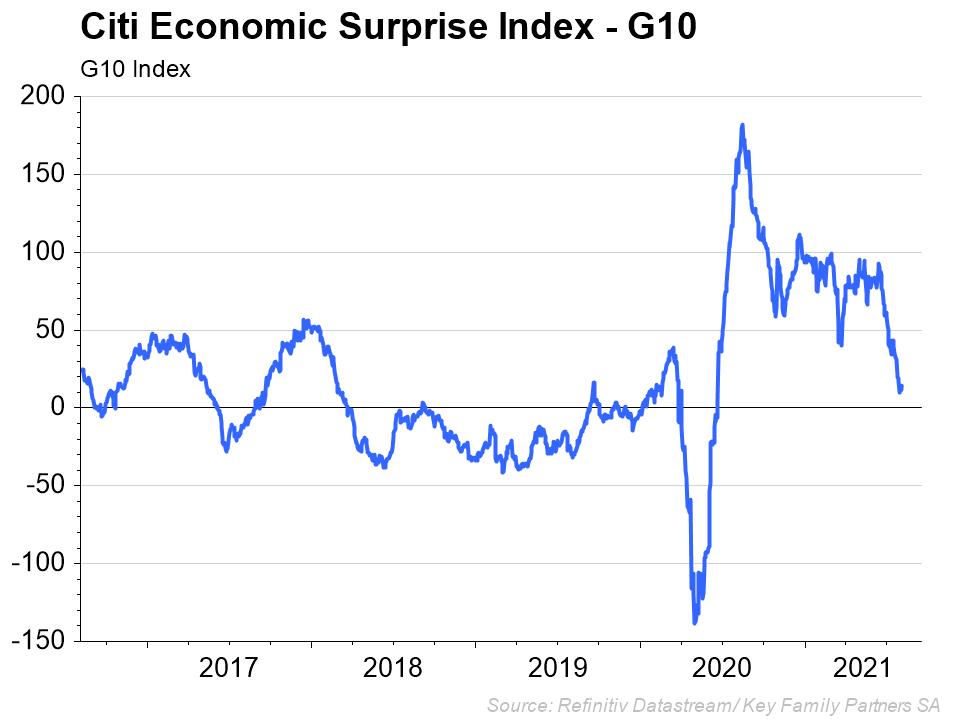

As previewed in last month’s report, global economic activity has started to slow from the breakneck levels seen in Q2. The global Citi Economic Surprise Index, which measures actual results against market expectations, is on a declining trend while remaining above the zero level for the time being. However, both the US and China are both somewhat below the zero level already (not shown). Essentially this means that in both countries, growth levels are already disappointing relative to expectations, with the US posting a 6.5% annualised Q2 growth rate, versus market expectations of 8.5%. Composite PMI numbers for July (where available) confirm this trend, with the US number falling to 59.7 in July from 63.7

While remaining generally positive, a declining economic growth rate can lead to market disappointments versus elevated consensus expectations for corporate earnings and other growth measures. This is especially true at this time, after Q2 earnings in the US have massively exceeded expectations, with 91% of the 255 companies in the S&P500 that have reported so far exceeding analyst expectations by an average of 17.8%. This has led analysts to raise year end earnings growth forecasts to 21.0% from 17.3% for the year as a whole; normally mid-year revisions for end year earnings are down, not up. Substantial scope for disappointment versus expectations has now been built into the market in the US. (NB A good example of this effect is Amazon’s Q2 results which disappointed vs forecasts, even though on-line store sales rose ONLY 16%, well below forecasts. Amazon’s share price fell -7.6% on the day.)

Inflation update

Core inflation rates continue to rise driven principally by input prices of materials, including energy, food and transportation. The US reached 4.5% in June while all other major economies are on rising trends. In addition, market based inflationary expectations have risen slightly on the month (see Fixed Income section below).

An important part of the debate on whether this inflation is transitory or not centres on the impact on real wages of economic growth and recovery from the pandemic, and whether they will be pushed higher and risk keeping the inflation rate elevated. An interesting study by the Federal Reserve of San Francisco titled “Longer-Run Economic Consequences of Pandemics” focused on 15 major pandemics over history, starting with the Black Death in the 14th century. This found that the economic effects generally persisted for 40 years after major pandemics and real wages were pushed higher because of a shortage of labour. Some evidence of this effect is being seen in the US today, with retirement numbers surging beyond normal levels and employers having to offer higher wages and better conditions to attract and retain staff (eg Walmart’s offer to pay 100% of employees’ college fees, and the lowest paid in the hospitality industry achieving 10% increases in wages). Whether this translates into the current pandemic experience is still open to debate – future data will settle it.

Monetary policy stays loose

The ECB, at its July meeting, has followed the Fed in being more flexible on future inflation levels – and confirming that it would keep buying bonds and maintaining its negative interest rate policy even if “transitory” inflation were to exceed its new target of 2%. Where the Fed goes, others are sure to follow….and the Fed’s Central Bank offsite in late August bears watching for signals on future Fed actions.

Also of note is that China has made a “pre-emptive” easing move by cutting the Reserve Ratio Requirement by banks by 50bps (to 8.9%). The impact is to expand banks’ capacity to lend and therefore head off any serious slowdown in the economy, some evidence of which has already been seen over the past few months. In this respect China is out of step with other central banks on monetary policy – as it has been throughout the pandemic. Nevertheless, this move is a positive move for Chinese (and global) growth.

In summary

- Global growth is on a slowing trajectory, with the risk of disappointment in equity markets in particular.

- China’s regulatory tightening is highlighting the political risks of investment in the country and EM more broadly.

- Inflation continues to rise, with increasing risks that it may not be as transitory as the Fed believes, while monetary policy remains loose.

For Investors…

- As market risks rise, maintaining broad diversification is more important than ever.

- Volatility in all markets is likely to rise as economic progress becomes less certain.

- Careful stock selection, especially in EM, is essential.

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).