KFP Market View in October 2020

For more detailed commentary on each major market or asset class. Download the full Monthly Market View here.

Time to take stock

Nine months into 2020 and six/seven months into the pandemic (and lockdowns) it is perhaps worth reviewing the state of the world economy and what we might expect in the coming 6-12 months. So much news, views and data are available that sometimes it is hard to see the facts from the fiction. I will try and stick to hard data to compile a current picture and glean some views for the near future of economic activity.

In market economies, the key economic drivers we need to understand are the future direction of growth and inflation. Both drive economic policy and ultimately the price of money and investment returns. Politics adds another layer of complexity and needs to be added to the pot to derive an appropriate investment outlook.

Growth

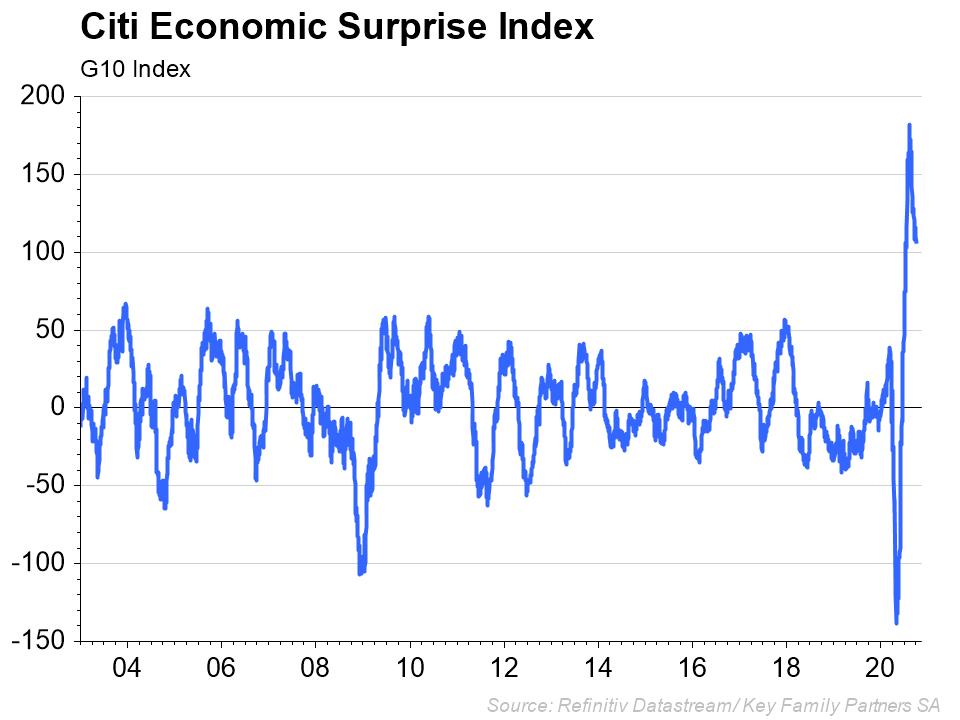

Q2 2020 saw the sharpest global economic contraction in economic activity in a generation or more, followed by a sharp recovery in Q3. Q3 GDP data is not yet available so we must rely on sub data that is available in more real time (nowcasts) to get an up to date picture. The Citi Economic Surprise Index (CESI) for the G10 nations shows clearly, since inception of the index, the depth of the economic contraction and subsequent recovery against market expectations (NB this is a relative, not an absolute, measure of GDP activity). Clearly the contraction and recovery were larger than initial expectations.

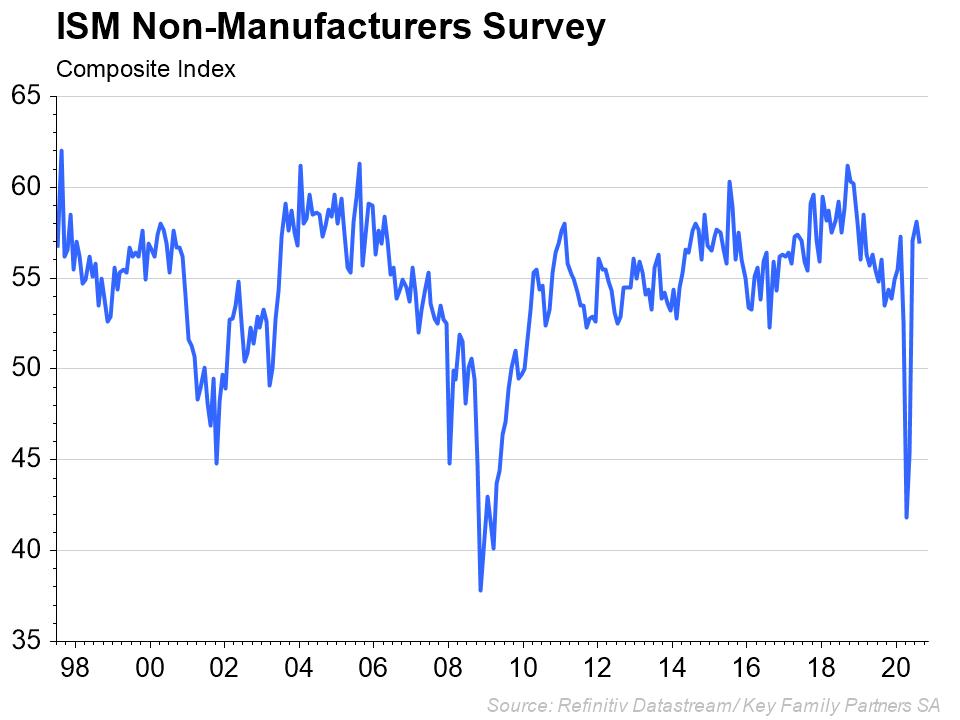

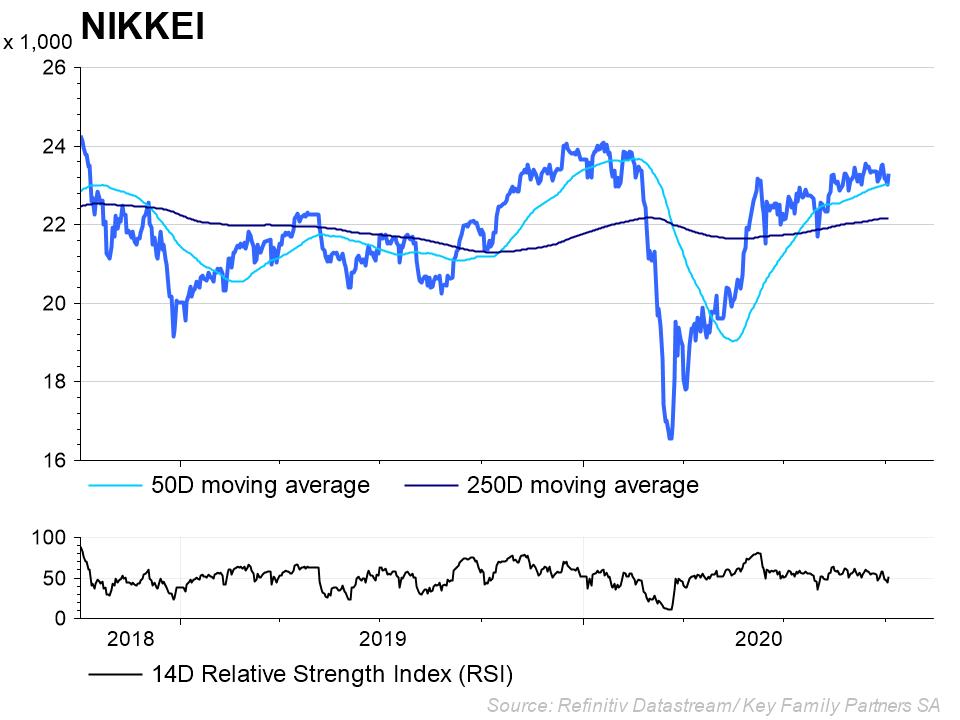

PMI numbers also provide a reasonable real time measure of economic activity change – that is, less than 50 represents contraction, and greater than 50 expansion, from the previous monthly reading. The chart for the US Composite PMIs clearly shows the growth recovery from June onwards. Other major economic blocks followed a broadly similar profile, with China’s recovery proving the most rapid and Japan’s the slowest. Note however the slight slowing in September, which was also consistent across major blocks, and principally in the services sector as new lockdown restrictions came into force.

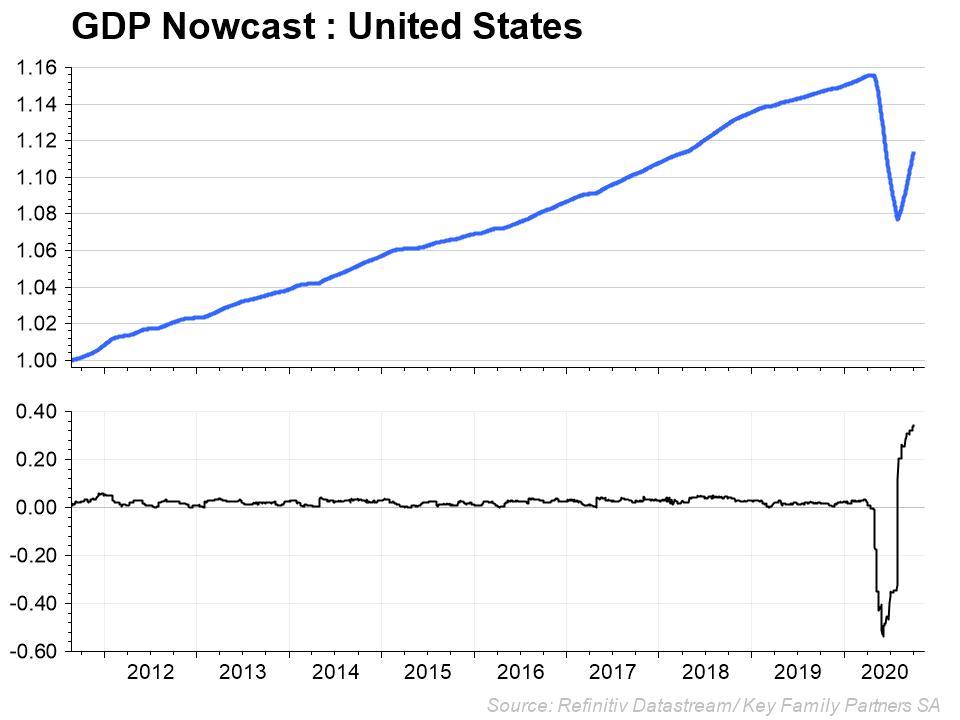

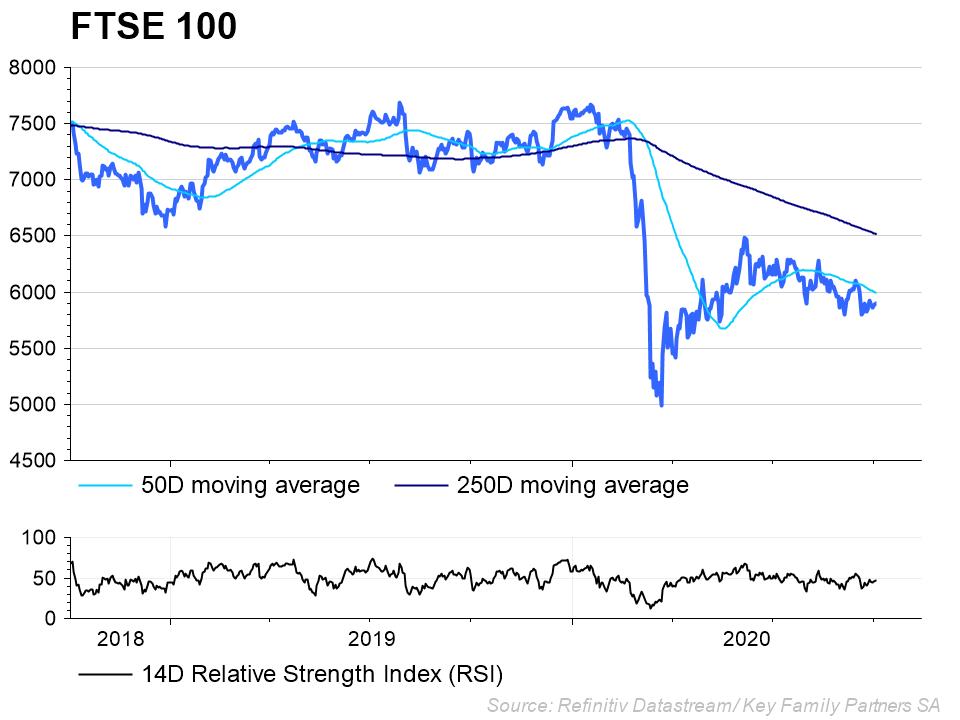

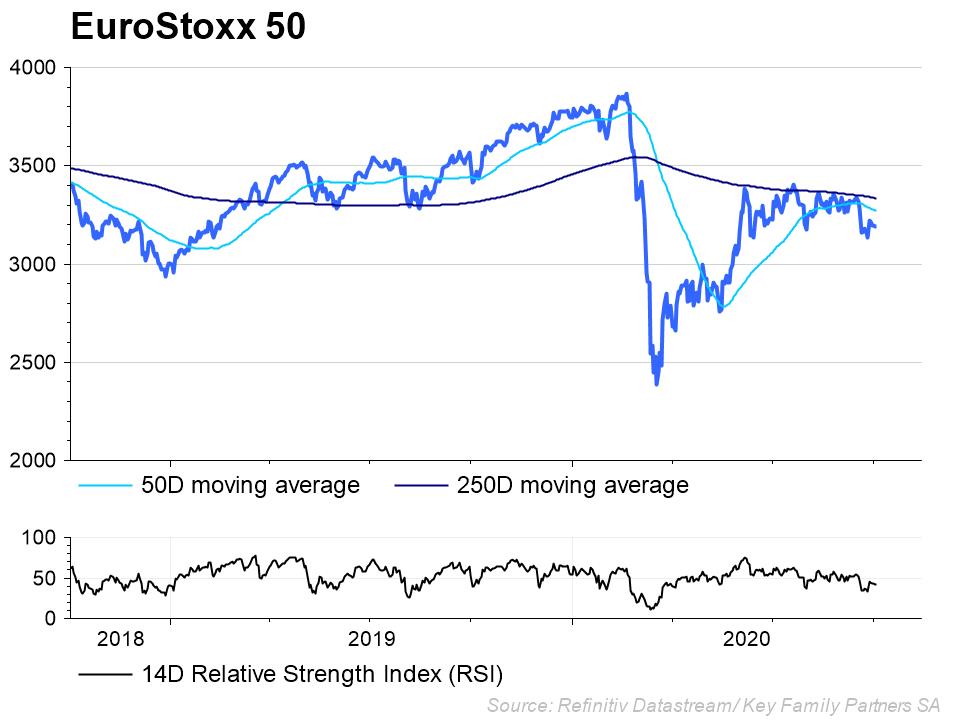

A measure of the current absolute level of global economic activity is provided by the nowcast from ECRI as part of their Leading Indexes service. The important point here is that although economic recovery is in place worldwide, the absolute level of economic activity remains well below the peak seen in January 2020, and close to the levels seen in 2017. The economy will continue to feel recessionary for some time ahead with growing unemployment and corporate bankruptcies – always lagging effects of recession. Most forecasters do not expect economic activity to recover to previous levels until 2022 at the earliest.

The conclusions to be gleaned from this data are that:

1) a growth recovery is well established in the global economy, albeit at different rates in different sectors and economic blocks, and

2) given the well publicised monetary and fiscal support from all major economies, this cyclical recovery is expected to continue for the foreseeable future as interest rates are kept at or near zero (or below) and fiscal support continues to expand, but

3) due to the extreme economic contraction already experienced it will take some years to get back to where we were before the pandemic struck.

The principal short term risk to this outlook is likely to be the political reaction to the continuing spread of Covid-19, and the extent of future economic lockdowns imposed by the politicians. The damage to business and consumer confidence and the “animal spirits” of investors is likely to be substantial. Longer term, the volume of debt being created by Governments to pay for the impact of the recession is also likely to weigh on growth prospects.

Inflation

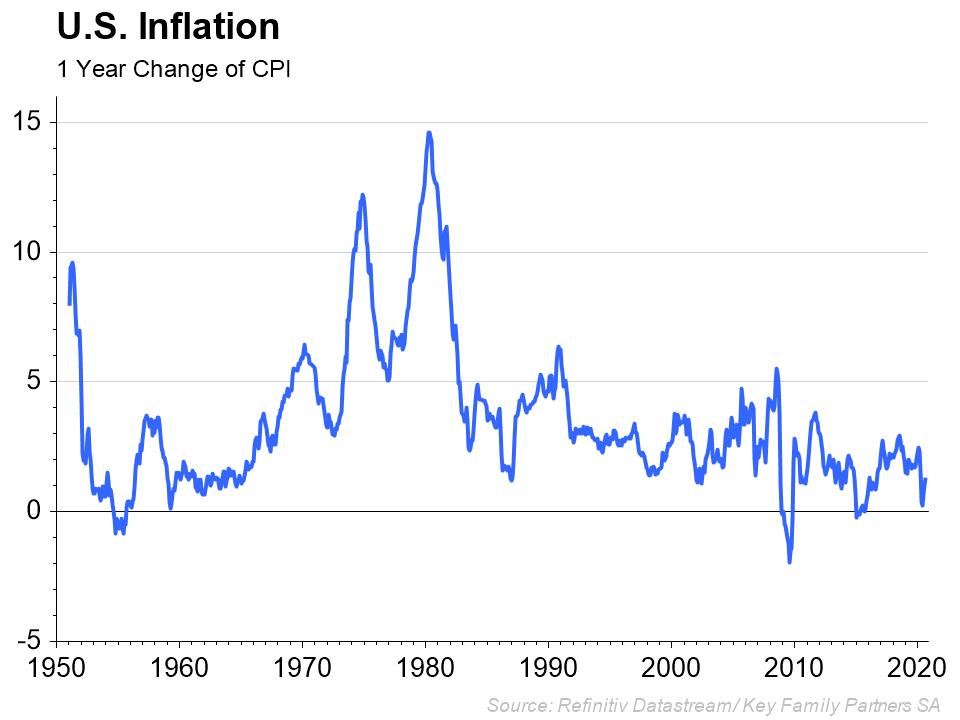

Consistent with historical experience, global inflation collapsed during the recession with numerous countries including the Eurozone and Japan recording negative rates. However, with the recovery in progress actual inflation and expected inflation rates are picking up in most economic areas.

US CPI year-on–year to August showed a recovery in prices as consumer spending picks up. Core inflation excluding food and energy costs rose to 1.7%. Nevertheless food prices which are a key component especially for the poorer people, were up 4.1% over the year, a trend which is being seen globally.

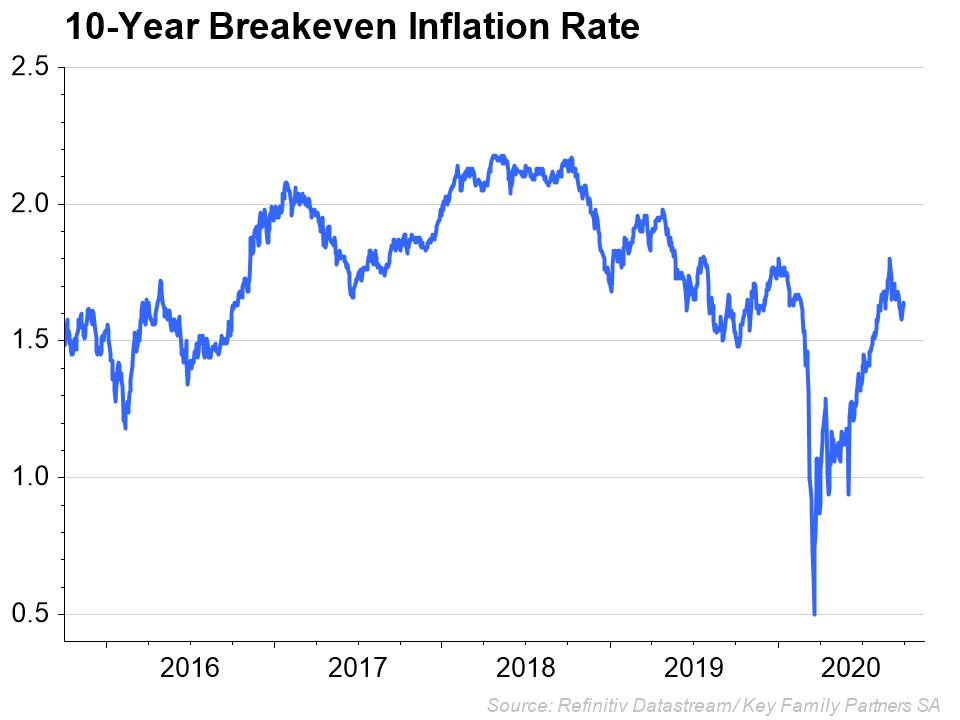

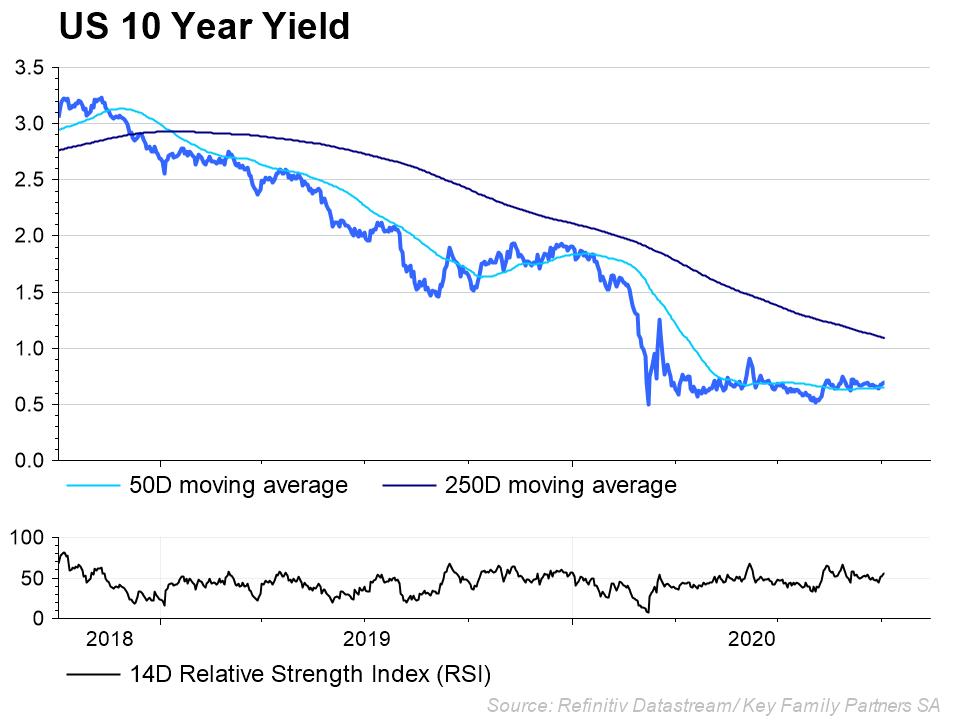

10 year break even inflation rates in the US have risen rapidly and have now recovered to levels last seen in 2019. The trend in inflation break even rates is now up and we can expect to see inflation pick up further for all the reasons discussed in previous papers.

Furthermore, leading indicators of inflation are now in cyclical upswings for most major economies, including the Eurozone which has been a recent laggard. The ECB continues to believe that deflation is a greater danger, as per their statements on Wednesday of last week, and will continue to provide greater monetary stimulus as required.

The conclusions from this data are

- Inflation pressures have returned, and risks are to the upside as economic growth recovers.

- Further monetary stimulus is likely from Central Banks including the ECB, adding fuel to the fire.

- Negative real interest rates will persist for some time.

Impact of politics

A myriad of major political risks exist today on a global scale with which readers will undoubtedly be familiar. Suffice to say here is that any of these major political risks, if they materialised in a negative manner, could have a significant impact on the economic recovery envisaged above. The most pressing of these is perhaps the November election in the US which today has no clear outcome. A contested result could be the worst scenario for investment markets.

In conclusion

- A global economic recovery has been established, but with a long way to go to reach levels of economic activity seen before the pandemic

- Inflation pressures are to the upside, while monetary and fiscal policies will keep base interest rates at near zero levels for the foreseeable future

- Political uncertainties have the real potential to derail the economic recovery

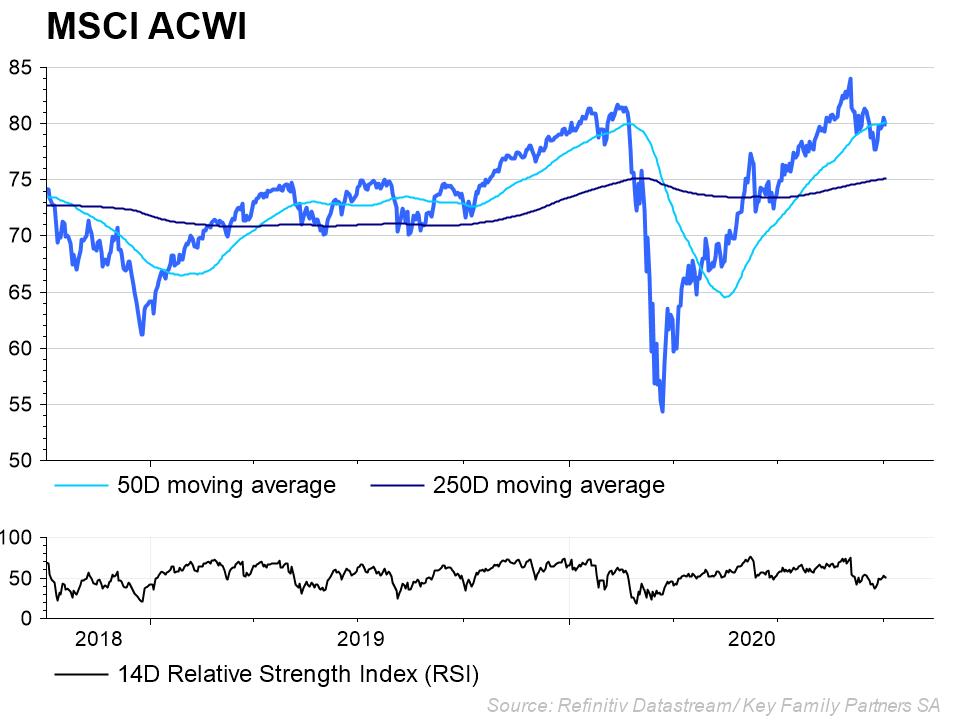

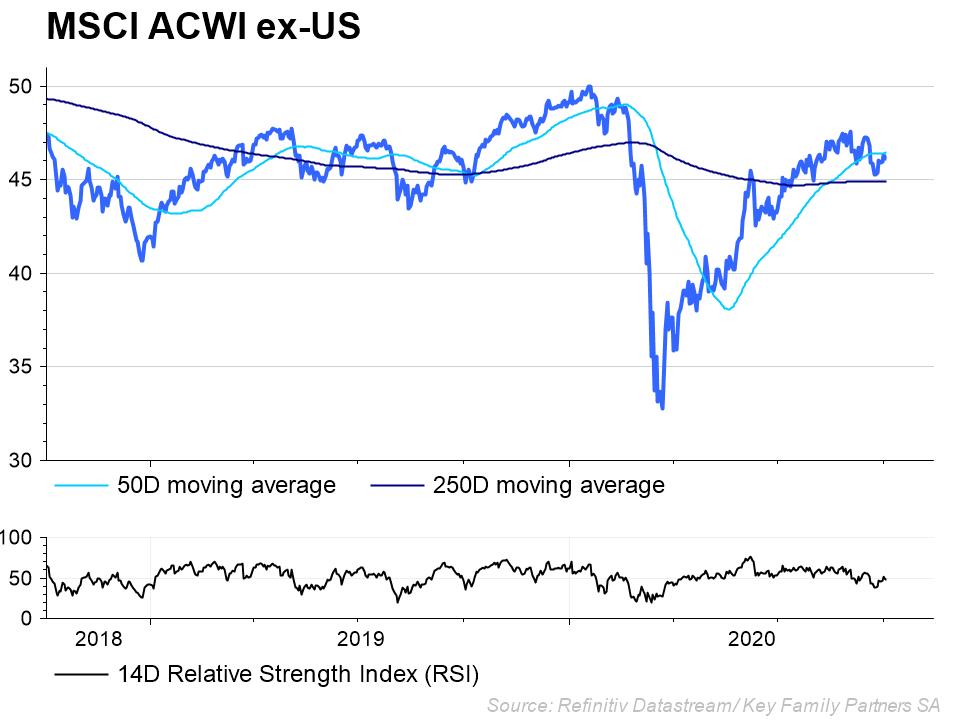

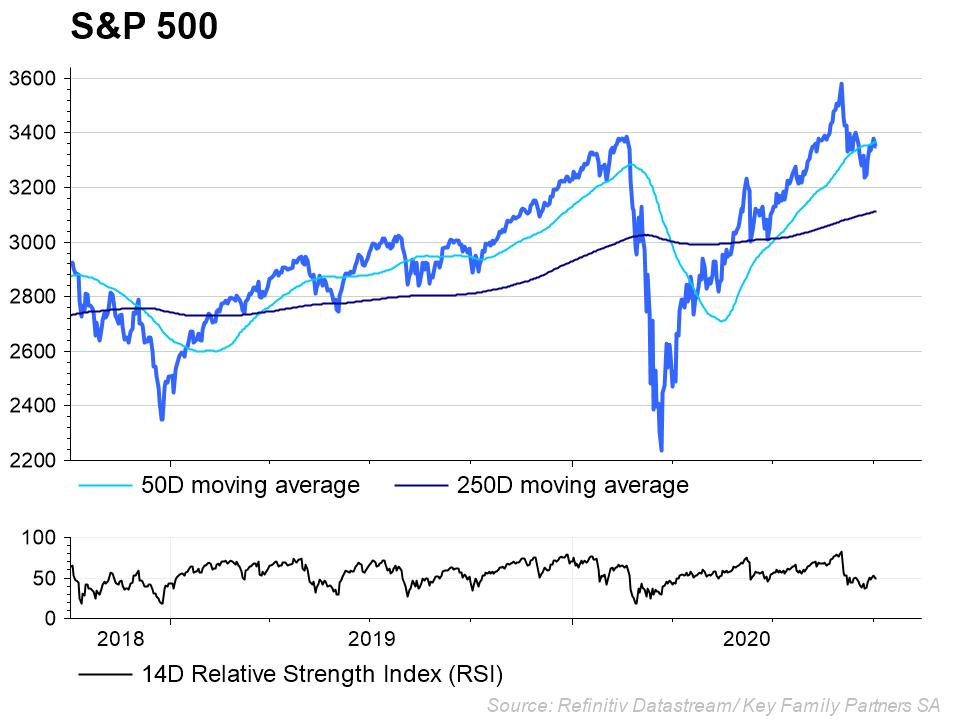

…and for investors

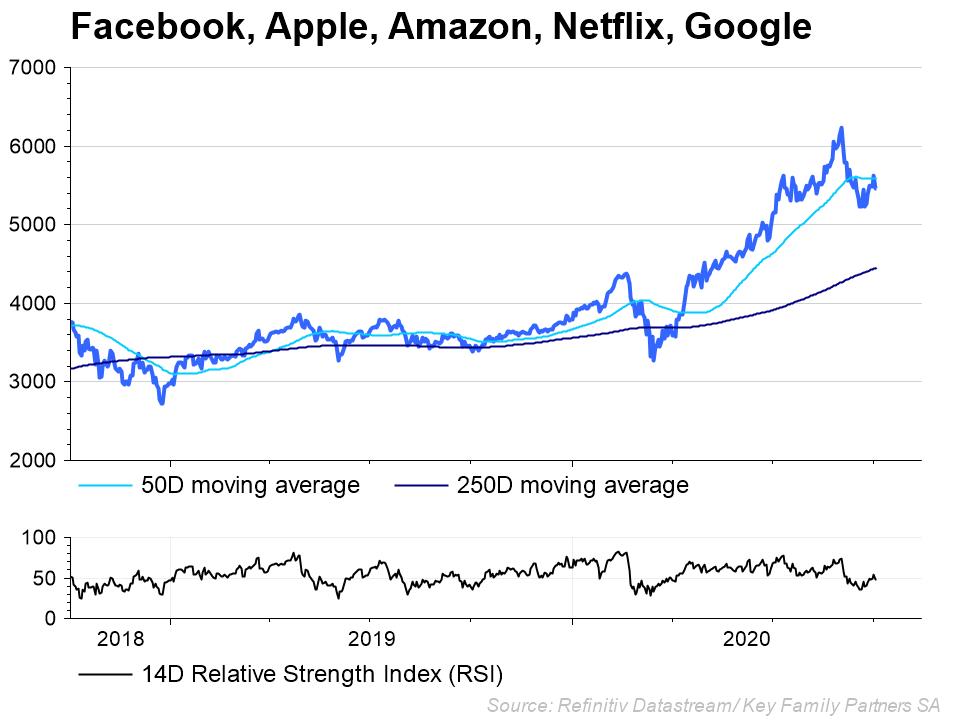

- Take advantage of the economic recovery by investing in those sectors and business that will prosper in the recovery and avoiding the zombies

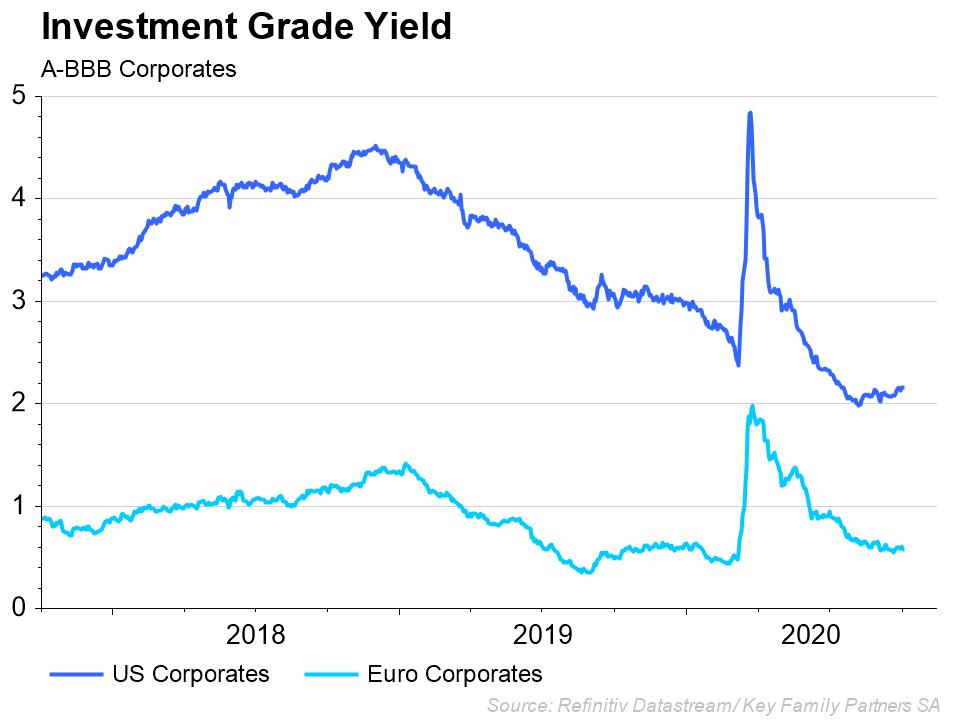

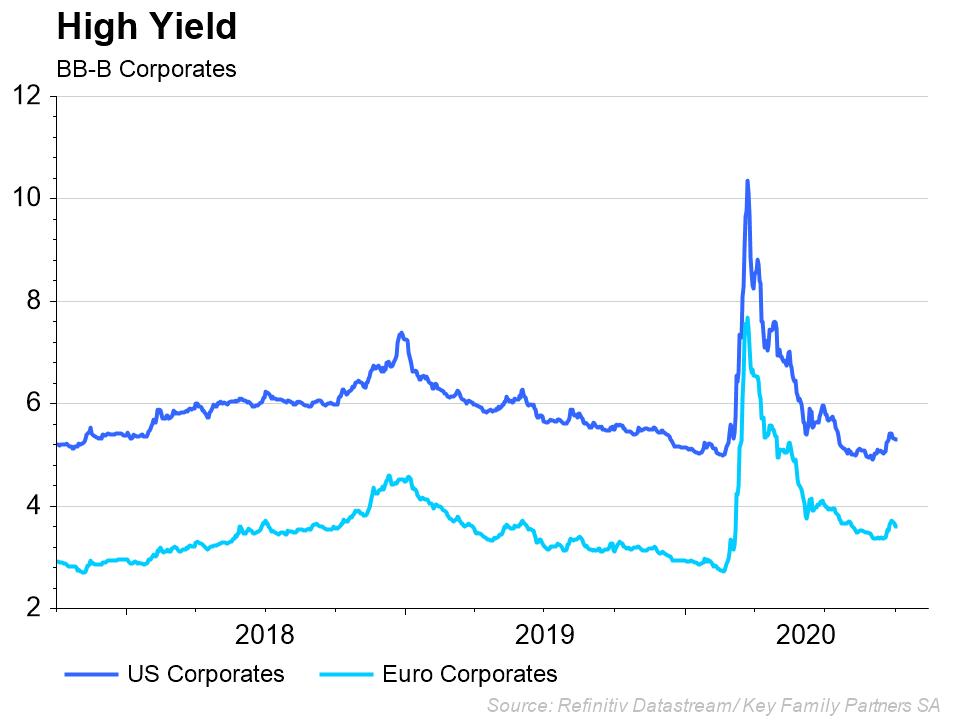

- Beware rising inflation and market interest rates and the negative impact on investment grade fixed income returns

- Hold decent allocations of safe haven assets (gold, swiss francs, etc) to protect against inflation and political risks

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).