KFP Market View in October 2021

GLOBAL ECONOMY

New Monetary tightening cycle at hand

The Federal Reserve finally got off the fence and announced plans for a new monetary tightening cycle to start later this year with a phased reduction in its bond buying programme (tapering of QE) to be completed by mid 2022. Thereafter, rate rises could start in the second half of the year, with a further 3 pencilled in for 2023.

The importance of the announcement is that the tapering and rate rises are being brought forward by 12 months or more in the face of higher and more persistent than expected inflation levels i.e. inflation may not be as transitory as first thought?

For the technically minded, a recent Fed paper examining the assumption that inflationary expectations are the main driver of actual future inflation concluded that the assumption “rests on very shaky ground” (https://www.federalreserve.gov/econres/feds/files/2021062pap.pdf).

This belief has been at the core of Fed policy decisions for some decades. But the paper suggests the belief is not supported by empirical evidence, throwing a spanner into Fed assumptions for the future direction of inflation. In particular, it may explain the change to the Fed’s “transitory inflation” position and the acceleration of monetary tightening.

It is not only the Fed that has embarked on a new tightening cycle. The ECB and the BoE are also looking at early tightening in the face of higher and more persistent than expected inflation rates, while some EMs (notably Brazil, Russia and Mexico) have seen multiple rate rises already this year. The one outlier remains China, which is on a modest loosening cycle given developments in their domestic economy (see below).

These tightening cycles usually last for multiple years, but given the fragility of the current economic recovery, any further economic slowdown (or even a new recession) may reverse the cycle. For the moment, investors should work on the assumption that monetary conditions will be tightening, and interest rates are likely to rise in 2022 if not before.

Growth recovery in 2022?

Economic commentators (e.g. J P Morgan) are beginning to discuss their outlooks for 2022, and a developing theme (although by no means consensus) is that we are likely to see a growth rebound after the 2021 slowdown. This assumes that the supply chain disruptions will be largely resolved (semiconductors included) and consumers will be eager to spend their substantial accumulated savings from the past few years.

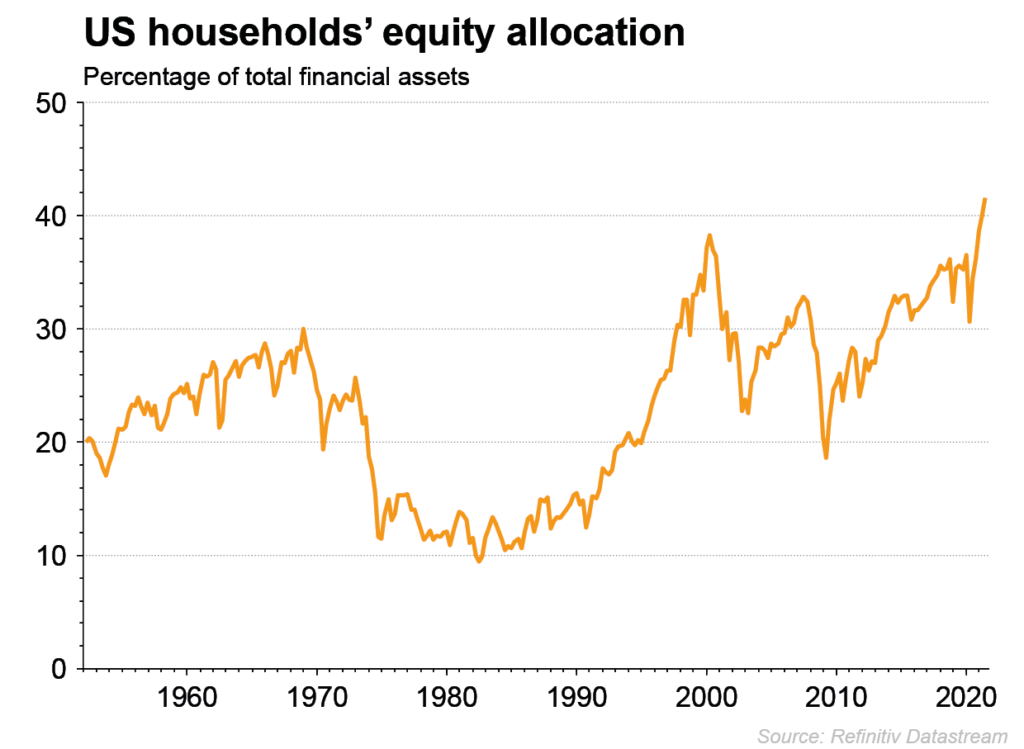

Based on Fed data, ING has calculated that household wealth in the US has grown by $26 trillion since the end of 2019 (and $32 trillion since the low point in 2020) to $159.3 trillion – an astonishing 21% increase in 18 months. With household liabilities at “only” $17.7 trillion, this leaves household net worth at $141.7 trillion – and at an all-time high against disposable incomes. The driver of this increase has been a combination of stimulus payments, wage increases and asset price appreciation.

Given the Fed goal of supporting the recovery and inflation with consumer spending, the asset price inflation driven by ultra-loose monetary policy appears to have worked, putting US households in a stronger financial position than ever. A consumer led boom next year in the US is therefore a real possibility if supply chain disruptions are resolved, and particularly if consumers buy early in anticipation of future price rises.

Stock Market Breadth

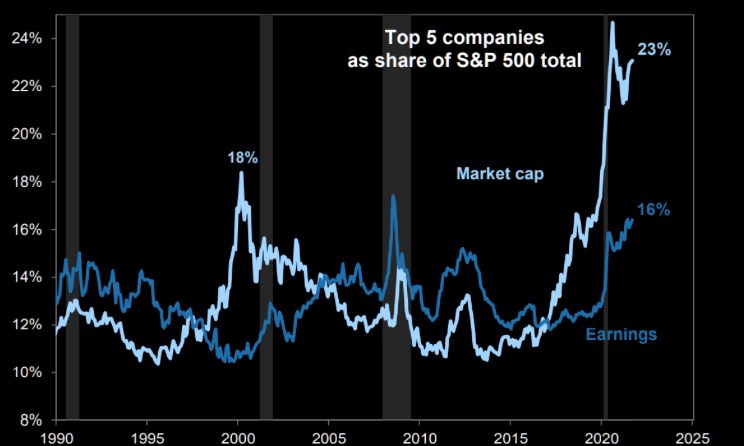

Despite a recent correction in US equity markets (see Equities below), market breadth remains very narrow. The chart attached (from GS) reinforces the point that valuations of the top 5 stocks by market cap now make up 23% of the total market capitalisation of the S&P500. In addition, the market cap proportion has substantially exceeded the share of earnings (16%) contributed by those 5 stocks. This suggests that the market performance is even more narrowly supported than was seen in 1999/2000. Given the recent moves in the Fed stance on monetary tightening, and the rise in market interest rates, these stretched valuations remain a significant risk to these stocks and the overall market level.

China update

Chinese equity and corporate debt markets have been rocked by the apparent imminent insolvency of Evergrande (or, maybe more appropriately, “Nevergrande”) one of China’s largest residential real estate developers. Total debts are believed to exceed $300 billion, of which $20 billion are USD denominated borrowings and the balance, domestic RMB debt. The overarching causes of the property crisis in China are overbuilding, excessive borrowings and government initiatives to control speculation in the property market – the usual causes of property busts.

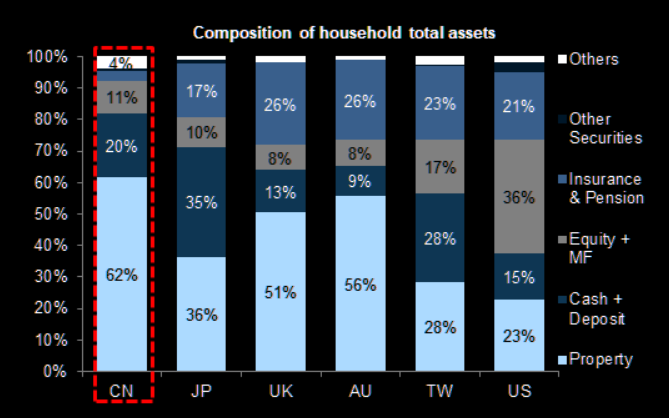

The failure of a major developer in China, and financial loss to lenders and investors, is likely to have a disproportionate impact on Chinese household investors relative to other countries, given the very high ratio of property asset value relative to total household assets in China. Property is seen as a safe, tradeable asset.

Anecdotally, Evergrande raised considerable amounts of high yield debt from retail investors in China who are now seeing defaults on interest payments, as are foreign investors on the most recent interest payments due on USD bonds.

The current market view is that the Government will protect retail investors, but equity and offshore debt investors may be left to the markets.

The overriding goal of the CCP is to maintain social stability in China and it is exactly this sort of event which could snowball into wider disorder, hence the protection of retail investors.

Loosening monetary policy is consistent with this view and policy is likely to become looser over the following months as the property market in China adjusts to current events.

Whether the insolvency of Evergrande (and other similarly indebted developers) becomes a systemic risk in China and abroad remains to be seen. A credit crunch, coupled with an apparent and growing electric power shortages impacting manufacturing and service business, could put China’s economy at risk of a near-term recession.

In summary

- The world economy, except for China, has entered a monetary tightening cycle, which could extend for some years as inflation appears more persistent and stuck at a higher level than expected.

- Interest rates are likely to rise across most G10 countries in 2022 and beyond

- Growth continues to slow, but with some upside potential in 2022 in the US

- Some risk to this scenario comes from China, should a full-scale domestic credit crisis develop

For Investors…

- Fixed income investments are likely to deliver very low to negative returns for the foreseeable future as inflation runs and interest rates rise

- Equity markets could also see lower returns as interest rates rise, and P/E ratios fall, particularly on higher priced stocks

- Commodity assets and commodity related stocks are likely to continue to perform as supply disruptions continue.

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).