KFP Market View in September 2021

GLOBAL ECONOMY

Taper whimper

The much anticipated Fed speech at the Central Bankers’ annual convention in Jackson Hole (held remotely on Friday 27th August) provided little new insight into the Fed’s plans for monetary tightening. On the contrary, Powell confirmed that tapering of the QE would probably start sometime this year and that interest rates would not be raised for some time thereafter. Equity and bond markets both produced a relief rally, in contrast to the last time tapering of QE was announced in 2013 which produced a market tantrum (sell off).

Inflation was still described as transitory despite much evidence to the contrary (see below), and no indication of the expected transitory period – is it 6 months, a year or longer? “Wait and see” remains the main policy, with Powell apparently keen to be reappointed as Chairman early next year and not wanting to “rock the boat” before then.

Growth slowdown

One area the Fed correctly highlighted was the slowing growth prospects, which are now clearly evident in most real time data release. The Citi Economic Surprise Index shows the trend of actual results against expectations and these have now turned negative globally, most notably in the US and China. What this tells us is that most current economic forecasts have been overly optimistic and actual performance is likely to disappoint over the next 6- 12 months.

Looking at August PMI data (where available) as a proxy for real time economic activity, which remains positive but slowing down for major economies except China, which posted a manufacturing PMI of 49.2. This suggests that manufacturing activity shrank in August in China, the first time since the brief Covid recession in 2020. A different measure of the August services PMI also fell to 47.5 from 53.3 in July. The main reasons given were the usual ones: Covid related curbs, supply bottlenecks, regulatory impacts, and rising prices.

This picture is consistent with the message from leading indicators some months ago of a forthcoming growth rate slowdown in the world economy. Those indicators remain in negative territory on a global basis, with China clearly taking the lead currently.

Transitory Inflation

The direction of inflation remains the big debate of the moment. The Fed is in one camp, and many commentators do not agree – including Larry Summers who has been a long- term critic of the current Fed policies, describing them as a “serene” depiction of inflation risks.

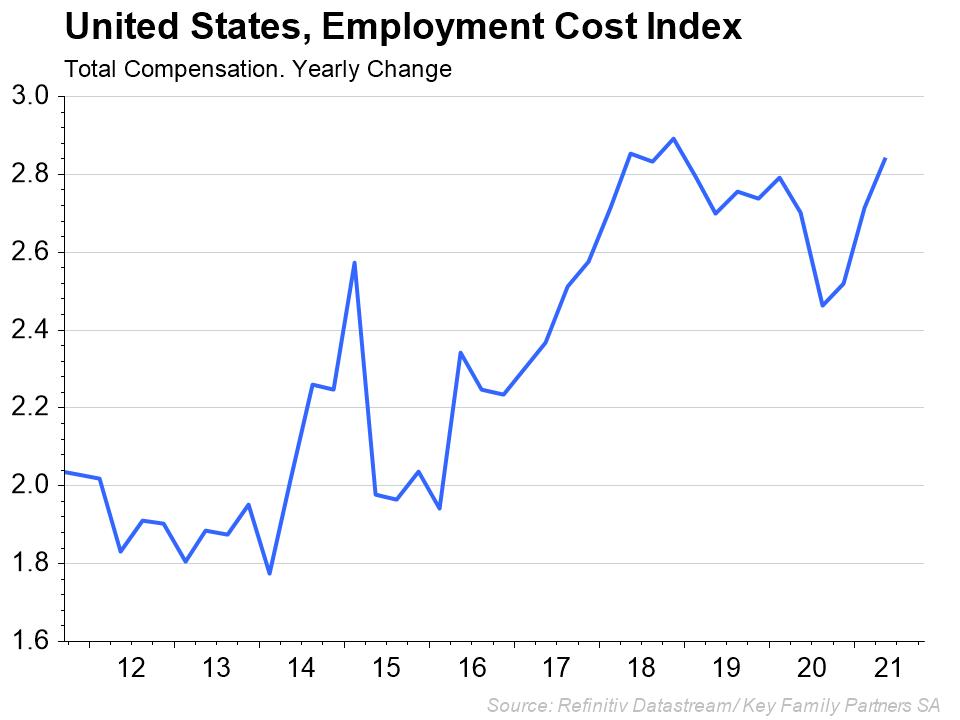

One part of the debate is whether wage increases are leading to a “wage-price spiral” in the economy. The chart shows US Employment Costs rising at an accelerating pace year on year. We are watching closely to see if this is transitory and what impact this will have to demand or, if any, to corporate earnings.

It is not just in the US that inflation has picked up faster than expected. The EU is seeing an equal increase to a 3.0% annual rate, above consensus estimates of 2.7%. The ECB remains firmly in the transitory camp, with no talk of tapering at any time in the foreseeable future.

As the 12 month base effect washes out over the next few months, it is likely that headline inflation will fall somewhat. Whether the other drivers of inflation, namely: supply disruptions, labour shortages, rising commodity prices and widening covid restrictions continue to drive prices higher remains to be seen. As Mark Twain observed: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Equity Markets

Equity markets continue to make record highs, particularly in the US, driven mainly by TINA (There Is No Alternative to equities) and momentum from the new Robinhood traders buying on any dip regardless of fundamentals. Robinhood, who offer commission free trading, saw the number of accounts grow from 7.2 million to over 18 million in the year to March 2021.

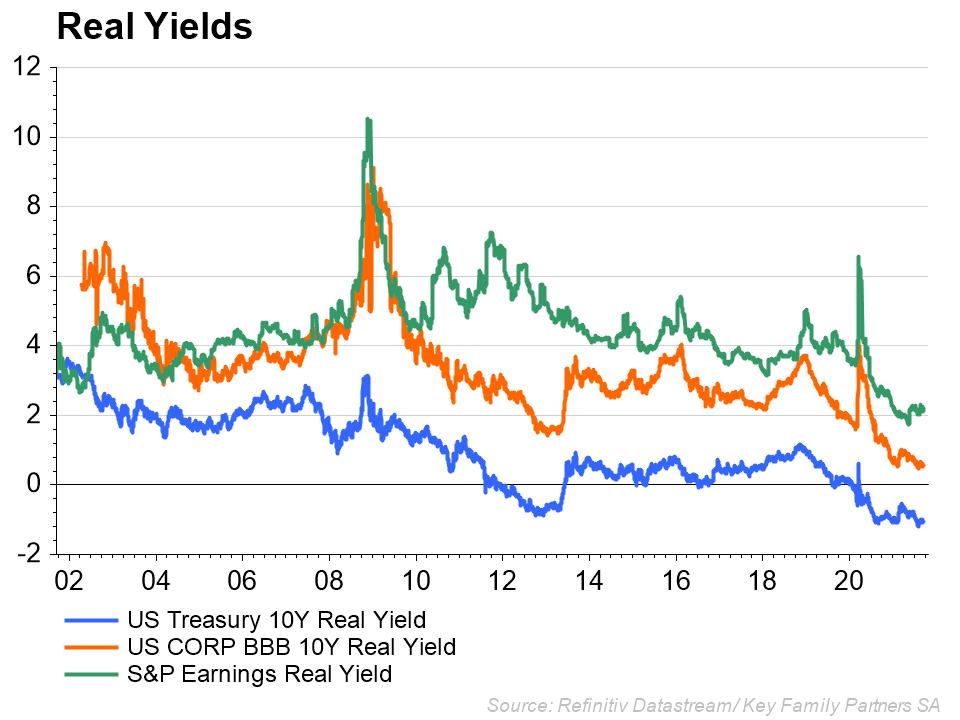

The Tina argument rests mainly on the fact that nominal Fixed Income yields are so low that we may as well buy equities which offer a higher dividend yield. The real yield of the S&P 500 still shows a positive return, though this risk ‘premium’ has tightened significantly with the recent rise in the equity markets and inflation. The benefit from equities is still there but much reduced. Any rise in real bond yields will begin to see that benefit disappear. Worryingly, US 10y Investment Grade Corporate Bond yields are at just 0.57%.

China update

China’s political and regulatory reforms show no sign of slowing– the latest include action against excessive after work drinking and limits on children’s access to online computer games to 3 hours a week. All these initiatives over the past year add up to a new revolution in China, moving away from the freewheeling markets and society of the past 20 years. The key commonality is further and extensive intrusion into personal and corporate life by the state, with the aid of digital data and technology.

These measures and the recent plunge in the Chinese equity markets prompted George Soros (who knows a few things about markets) to write a headline in the FT: “Investors in Xi’s China face a rude awakening”. The premise being that Xi does not understand how markets work, but does consider all Chinese companies to be instruments of a one party state.

In summary

- Despite rising inflationary pressures the Fed has confirmed a very gradual tapering of QE and no rate rises on the horizon. The ECB is even more dove-ish

- The recovery in the world economy is slowing, most notably in China

- Equity market risk is rising as market breadth shrinks and valuations rise

For Investors…

- Maintain diversification discipline including anti-fragile assets (ie commodities and real estate)

- Rotate out of higher risk equity to more value orientated equities

- Keep Fixed income duration short and quality high

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).