KFP Market View in April 2021

GLOBAL ECONOMY

Early Warning Signals?

While real time economic data continues to follow the recent growth and inflation script from previous Global Market View reports, a number of recent events in financial markets might serve as early warning signs of trouble ahead – rather as singing canaries signalled forthcoming danger in coal mines before the advent of electronics.

Firstly, the bankruptcy of Greensill Capital in early March. The supply chain (trade finance) financing company, which was valued at $3.5billion less than two years ago when Softbank invested $1.5billion, collapsed after insurers withdrew $4.6 billion of insurance cover on the trade finance loans it had extended. Without the insurance Greensill could no longer raise further funds to make new loans to its clients, forcing some of those to the brink of default – and Greensill to default on its own funding.

Secondly, an investment firm (Archegos Capital Management) defaulted on margin calls for its highly leveraged, estimated $50billion portfolio (FT) of mainly tech stocks in the US and China, leading to the forced liquidation of the portfolio and 100% loss of the firm’s capital – and large losses for the banking institutions that had provided the leverage. The stocks were not held directly but through total return swaps and other derivatives with financial counterparties, and thus evaded disclosure rules on the stocks held. The proximate cause was a decline in tech stock prices over the previous days before the margin call – and especially in Viacom, one of the largest holdings in the portfolio, although the full details are not yet public.

Why is this important, and what is the connection between the two events? Both can be linked directly to the impact of rising USD interest rates, bringing memories of 2008 and earlier financial crises.

Financing was provided by Greensill to companies such as Abengoa of Spain (filed for insolvency in February) and GPG of the UK (at risk of bankruptcy, seeking Government support), both highly leveraged firms which relied on Greensill financing– classic “zombie” companies which have been impacted by rising USD interest rates. Greensill used securitised funds to raise money from HNW and institutional investors on the basis that the underlying assets (loans to Greensill clients) were insured. Those investors, and the equity providers, are likely to see $billions in losses.

In the case of Archegos, the lack of transparency in its operations raises the question of how many other significant investment vehicles exist with similar levels of leverage, which could destabilise financial markets as longer term interest rates continue to rise?

Back in 2007, similar early warnings were provided by the failure of two leveraged Bear Sterns funds, which were invested in sub-prime mortgages (via securitised CDOs), and which eventually led to the failure of Bear Sterns itself. The rest is the history of the 2008/9 financial crash.

In 1998, the failure of the fund Long Term Capital Management (it was not long term and managed to lose all its capital) was driven by high leverage on EM bonds during the 1997 Asian financial crisis. The Fed arranged an orderly liquidation of the fund to avert a financial market meltdown.

Today we have some similar characteristics: rising longer-term USD interest rates in a highly leveraged environment, negatively impacting bond prices and equity market valuation multiples (especially in the tech sector) and the financial viability of ‘zombie’ companies.

Are these warning signs a prelude to another economic and financial crisis, or are they one off company specific events? The answer probably lies in the future course of USD interest rates – and the Fed’s reaction. The pressure on the Fed to implement some Yield Curve Control is growing.

Growth and inflation on course

As described in prior reports the world economy is on course for a strong economic recovery and rising inflation. The latest figures confirm this outlook:

Growth

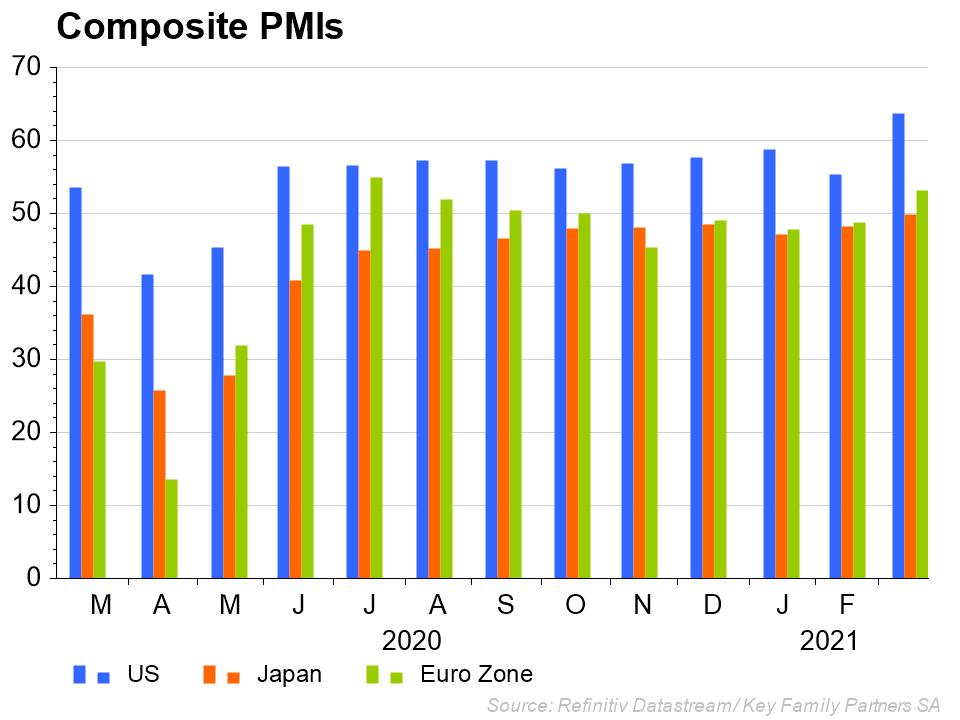

Composite PMI data continues to show expansion across the world suggesting the expected recovery remains on track

Note that China’s PMI remains stable and slightly positive up to end February, March data not yet being available. Renewed lock down restrictions in the EU may delay the anticipated recovery, but is not expected to tip it back into recession. The UK continues to recover strongly as lockdown restrictions continue to be lifted, even though Q1 GDP is expected to show a contraction of approximately 2.0%

Recovery stimulus continues to flow from US Government’s coffers. The Administration announced $2 trillion of new fiscal spending on infrastructure and manufacturing subsidies (with a green and technology bias), adding to the already substantial stimulus to the economy over the past year. However, the difference this time is that corporate taxes will be raised to pay for the spending, raising strong protests from the opposition party, but perhaps avoiding another large expansion of the deficit. The price of higher taxes will be a reduction in after tax earnings for US companies, estimate to reduce earnings yield from 2.1% to 1.9% – approximately 10%, and with implications for equity market valuations.

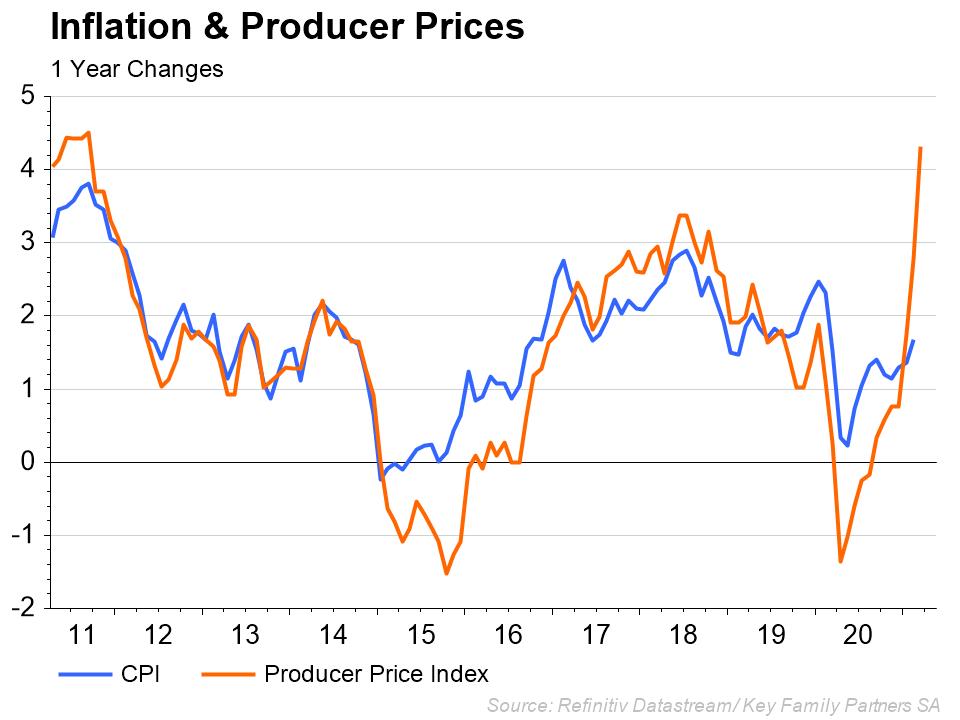

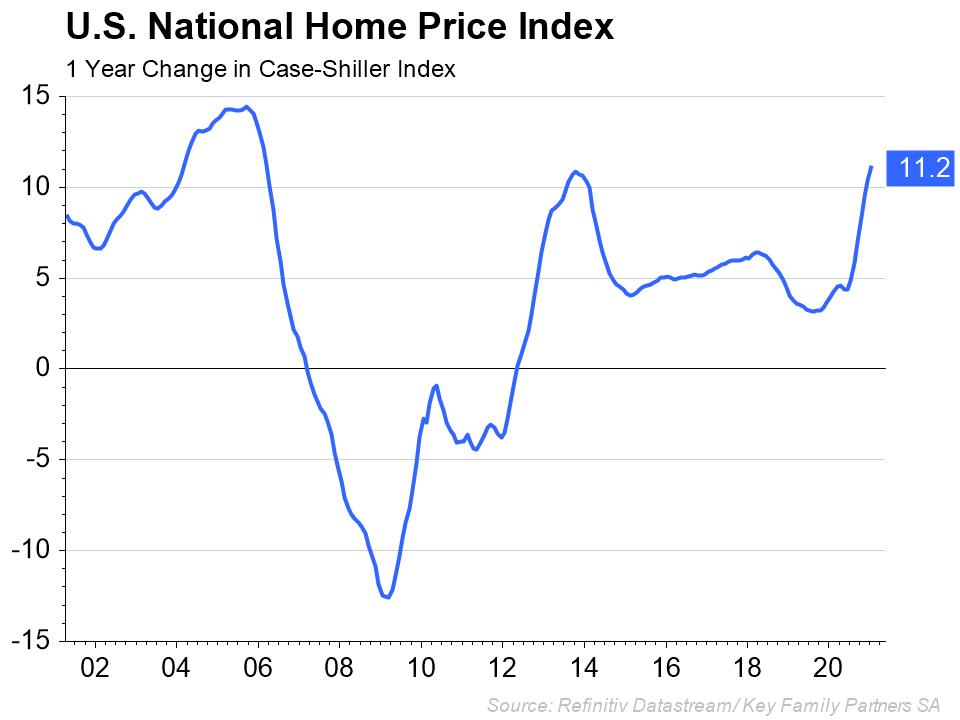

Evidence of rising inflationary pressures are coming in daily, from commodity price impact on CPI (left hand chart) to housing price rises in the US (right hand chart) driven by a shortage of new housing supply.

Inflation

Most importantly, inflation expectations continue to rise strongly. 2-year expectations have now risen to 2.7%, substantially exceeding the Fed target at 2.0%. 2-year Treasury yields remain anchored at 0.16% providing strong negative real yields over that period, while 10-year yields have risen to 1.71% (from 1.42% at the beginning of March).

The impact on inflation of cost push (raw materials and labour) and demand pull from a strong recovery is being augmented by supply disruptions and bottlenecks – the most recent being the blockage of the Suez Canal – meaning that inflationary expectations may be under-estimated over the next 12 months.

The impact of rising price inflation on asset market performance has been the subject of much debate and study, but the conclusion seems to be (from Bridgewater):

- In the first two years of rising inflation, equity markets, gold and commodities provide positive nominal and real returns, while bonds and cash are flat to negative.

- Thereafter if inflation keeps rising, equity and bond real returns turn negative while commodities and gold continue to deliver positive returns.

These are important conclusions for investors given where we are in the inflation cycle.

In summary

- Some early warning signals on the economy may have been seen, driven by higher market interest rates

- Meanwhile, the economic recovery is on track albeit at differing rates across economic blocks

- Inflation is pushing higher and may exceed expectations over the coming months

For Investors…

- Continue to hold equities for the recovery/growth outlook, but beware early warning signs of trouble ahead from rising interest rates

- Continue to be cautious on any fixed income investments.

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).