KFP Market View in February 2021

A brief summary of markets in 2020

In the absence of my usual “the Good, the Bad and the Ugly” commentary last December on global markets over the past year, it may be useful to summarise some important features of investment markets in 2020 for future reference:

- The Good: In spite of the short, but deep recession in early 2020, equity markets generally finished well ahead, with Nasdaq leading the pack with a 43.6% gain. Equity markets globally (except the UK) benefitted from expectations of economic recovery post Covid and falling interest rates. Both bonds (US Aggregate +7.6%) and gold (+25.1%) performed well over the year on falling interest rates

- The Bad: The USD fell 6.7% against a basket of currencies (DXY) in developed markets driven by zero interest rates and growing twin deficits in the US

- The Ugly: The UK FTSE100 fell 14.3%, driven by Brexit fears and the deepest recession amongst developed economies. The FTSE100 is “tech-light” and therefore did not benefit from the bull market in tech stocks.

2020 turned out to be a good year for global investors, driven by unparalleled financial stimulus in all major markets that reduced interest rates to near zero or lower (except in EM). Furthermore, expectations of a rapid exit from the economic impact of the lockdown measures due to mass vaccination fuelled the equity markets towards year end.

Tech stocks were clearly seen as the winners in the Covid world as they benefitted from changes in consumer behaviour towards a more digital life. Valuations rose to very elevated levels, as shown in extremis by the Tesla share price. However, a rotation out of tech stocks (growth) towards recovery (value) stocks was seen towards year end following the widest ever performance differential between the two sectors over the past few years.

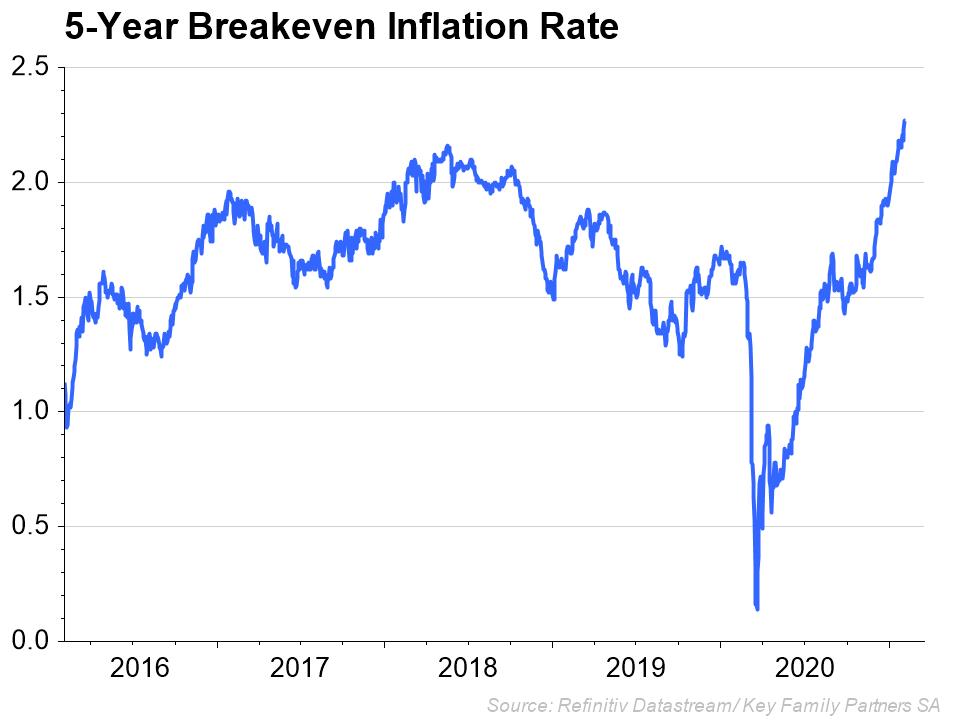

Market interest rates started to rise in the US with 10Y Treasury yields rising from 0.50% in late August to 0.92% at year end. Rising inflationary expectations drove the rise in yields.

In summary, at year end we had:

- Equity markets generally in a bull phase, with tech stocks especially at extreme valuation levels – how much higher can these markets go?

- Yields on Treasuries and investment grade fixed income beginning to rise after reaching low levels not previously seen in our lifetimes

- A weakening USD as twin deficits rose rapidly

- Gold trading sideways as market yields started to rise

- Commodity prices rising on economic recovery expectations

Will these trends continue into 2021 and if not, what might be the changes? These questions are addressed in the following sections.

GLOBAL ECONOMY

Economic Recovery – near term

Perhaps surprisingly given the continuing spread of the pandemic, the global economy continues to recover from the recession in 2020 – with the exception of the EU and UK which have slipped back into economic contraction based on the latest PMI data for January. The Citi Economic Surprise Index-Global- remains in strong positive territory, suggesting that economic data continues to be better than expectations on a global level. All major countries are in positive territory according to the CESI data, but with China showing the lowest individual reading (+23) and probably reflecting the fact that their economic recovery from the recession in 2020 is the most advanced amongst major economies. Nevertheless, the most recent PMI data from the EU and UK has pointed to a renewed economic contraction ahead – a direct result of the draconian new lock down arrangements being introduced in both economies, and in spite of the rapid vaccination progress being seen in the UK. The composite number hides the fact that in both cases manufacturing has remained in expansion mode (ie above the 50 level) whereas it has been the service sectors that have taken the biggest hit. This is perhaps not surprising given the lock down arrangements introduced, particularly in the UK.

This data suggests that for most of the global economy where economic restrictions are not too severe (China, USA) the economic recovery should continue, while for the UK and EU it is likely to be postponed by a quarter or two of this year. Other countries (Japan, Korea) have seen renewed virus activity and have started introducing new lock down restrictions, which may also delay their recoveries.

Thus, in the short term (the next 1-2 quarters) we can conclude that the economic recovery is likely to be lumpy, depending largely on the success of vaccination programmes and the impact of economic restrictions introduced by countries to control the spread of the virus. The excessive enthusiasm for a strong early recovery seen at the start of the year is likely to be exactly that – excessive enthusiasm.

Economic Recovery – Longer term

Longer term the successful recovery of the global economy in 2021 might depend largely on two major factors:

- The success, or otherwise, of vaccination programmes now being rolled out in many countries

- The impact of fiscal and monetary stimulus being applied now and in the future to the world economy

1) The vaccination programmes

The extraordinary success worldwide in developing new Covid vaccinations, including completely new technologies, has been well reported. What has attracted less attention (until recently with Astra-Zeneca vs the EU) is the challenge of actually supplying all the new vaccines in the quantities indicated.

- In 2018, the world produced 5 billion vaccines of all types

- In 2021, manufactures have offered to produce 11 billion Covid only vaccines (on a “reasonable best efforts” basis, of course) to be sold to those contracted for purchases.

The challenges to achieving this level of new production are huge, and delays have already given rise to serious political issues between the UK and EU.

Consider the following:

- Many of the vaccines are completely new (mRNA), requiring new manufacturing techniques.

- Some essential raw materials are in short supply (for example, horseshoe crab blood used for testing for contaminants).

- Specialised glass vials that do not react with the vaccine are in short supply.

- Filling, packaging and maintaining cold storage for some vaccines are a new challenge.

- Delivering the vaccination to patients requires abundant supplies of medical equipment including syringes – not always available on demand, as we saw in the first wave.

Therefore, actually meeting the vaccination target of many countries could, and already has in some cases, been delayed by the production and distribution challenges that have been created. In all countries with advanced vaccination programmes, some supply shortfalls have already arisen, thereby delaying the return to “normal” life and the expected economic recovery.

The risk to the economic recovery from vaccine supply shortages is therefore real for the balance of 2021 at least.

2) Financial Stimulus

On the other hand, financial stimulus has been provided already in quantities not seen since WWII to support the economic recovery from the Covid recession.

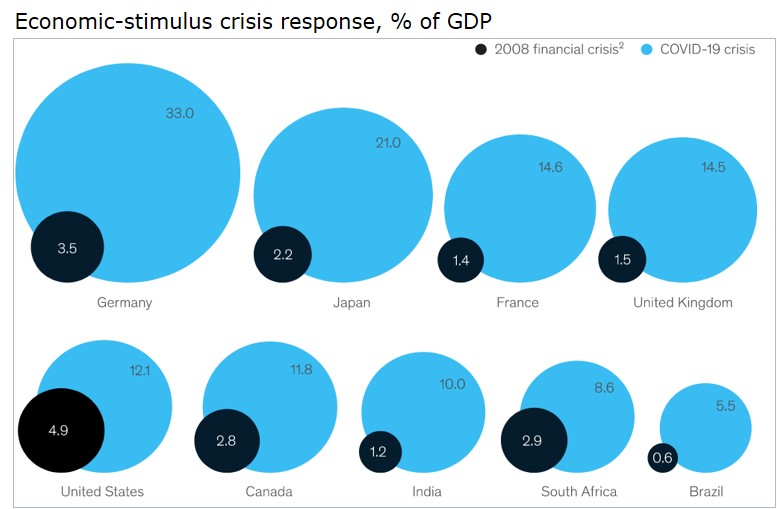

Both monetary and fiscal measures have been implemented in all major developed economies to a greater or lesser extent, and in all cases (except China) substantially greater than during the Great Financial Crisis (GFC). The most compelling chart I have seen of the magnitude of the stimulus driven by the pandemic is the following, showing total stimulus as a percentage of GDP of each country, with perhaps a surprising result:

(NB – China does not make it onto this chart as its stimulus level has been limited in this crisis, unlike the huge stimulus provided after the GFC where China delivered the largest stimulus of approx. 10% of GDP).

The stimulus from developed economies in this crisis has been a combination of monetary (interest rate reduction +QE) and fiscal policy (Government deficit spending), whereas the GFC stimulus was mainly concentrated on monetary policy. Central Banks and Governments have worked in unison this time, giving rise to concerns about Central Bank independence in the future – and prospects for significantly higher inflation than we have seen over the past 40 years.

The impact of current monetary policy can be seen in the level of interest rates and QE in most developed economies. Using the US as the lead example:

Interest rates: The Fed cut interest rates aggressively in March 2020 as the scale of the recession became apparent. This pushed REAL interest rates (ie after adjusting for inflation) into strongly negative territory, where it has remained except for a brief period in April/May 2020. Furthermore, the Fed has effectively committed to keeping interest rates negative for a considerable time into the future with its new “average” inflation target.

At the same time the Fed embarked on a massive bond buying programme (QE) to control market interest rates across the risk spectrum – including High Yield debt for the first time. These actions have doubled the Fed balance sheet total to in excess of $7trillion (vs GDP of approximately $20 trillion), the highest level seen since WWII. The Fed (and other Central Banks) has also bought newly issued Government debt, effectively financing Government spending with newly printed money.

In classic Keynesian economic orthodoxy, these actions are designed to maintain demand levels in the economy by slashing the price of money, and making ‘safe’ investments (ie US Treasuries) less attractive, forcing investment into riskier assets.

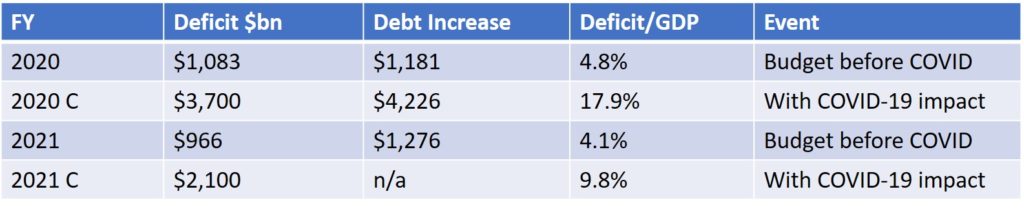

On top of these actions, Governments embarked on an expanded Fiscal Policy of deficit spending – that is spending money that is borrowed rather than generated from taxes. The table below highlights the increase in deficit spending in the US as a result of the Covid stimulus. NB These numbers do not include the fiscal proposals from the new Administration.

The UK, EU and Japan have followed similar strategies with the resulting substantial increase in current Government deficits and debt levels.

These policies can both be considered Keynesian, but the deficit spending has been supported by the “new” Modern Monetary Theory (MMT) which has reduced concerns about the size of Government deficits. MMT has been effectively adopted by all major economies except China over the past 12 months.

By contrast, traditional monetary policy (i.e. non-Keynesian) held that in order to control inflation and develop healthy sustainable growth, interest rates should be held at a real rate of around inflation + economic growth– i.e. money had a price, rather than effectively free as it now stands. This monetary approach has been largely discarded in the last 12 months by all developed economies – but not, on the whole, in Emerging Markets.

In summary, the financial stimulus in DM has reverted to a classic Keynesian model, with support from MMT. The impact is likely to be dramatic – as set out below.

Likely longer-term economic impact of Covid Stimulus

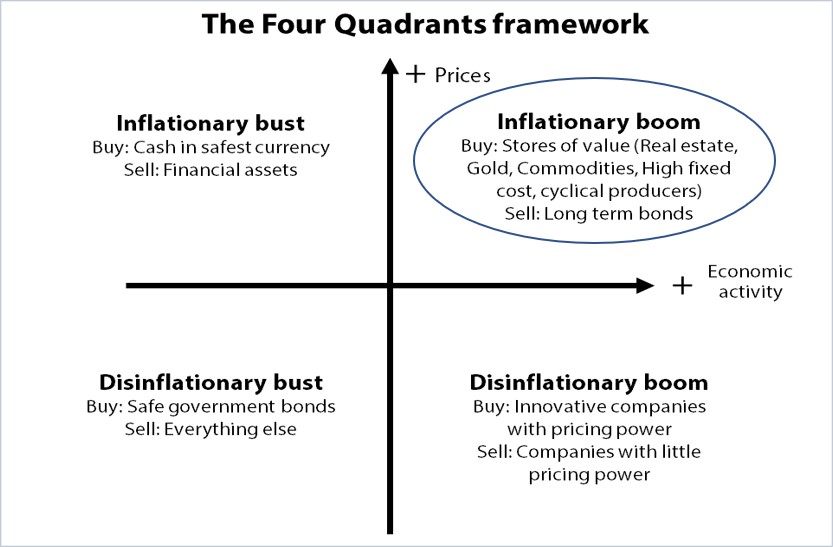

Valuable research by Gavekal Research has explained different phases of economic activity, and investment consequences, as follows:

Furthermore, their research points squarely to the top right-hand quadrant as being the most likely longer-term outcome of the current Keynesian and MMT policies being pursued in DM, and with which I concur.

The basis for this outlook is: continuing negative interest rates in all DM economies; huge build up in money supply, where M1 in the US has increased by 66% over the past 12 months; pent up consumer demand from lockdown restrictions vs supply constraints on both manufactured goods and services.

Some elements of the inflationary boom can already be seen in economic growth figures (except Europe as explained above) and rising inflation expectations, which have now reached the highest level since 2013.

This scenario is likely to accelerate once the impact of mass vaccination starts to loosen economic restrictions currently in place with market interest rates likely to rise in tandem

In summary

- Short-term, the economic recovery continues but some risks remain, particularly with the production and distribution of the new vaccines

- Longer-term, the economic stimulus policies being pursued by DM Governments is likely to lead to an inflationary boom, assuming the vaccination programmes are as effective as expected

The consequences for investors are profound; in particular rising market interest rates are likely to impact negatively both fixed income and equity markets so further adjustments to asset allocation towards appropriate assets will be required to protect against these events.

For more detailed commentary on each major market or asset class. Download the full Monthly Market View HERE.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO.

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).