KFP Market View in November 2020

For more detailed commentary on each major market or asset class. Download the full Monthly Market View here.

Don’t sweat the small stuff – focus on China

What was the most important economic event in October? Not just in today’s C-19 dominated world, but providing a clear direction for global economic development over the next decade or two – or longer?

Amongst the many pieces of global data (positive and negative) over the past month, the one that stood out as arguably the most important in the long term was the world’s largest ever IPO of Ant Group (Ant), raising $34billion in Hong Kong and Shanghai. As readers will know, Ant is a Chinese FinTech business offering a digital payment platform with over 1 billion users, and the world’s largest money market fund with over 588million users (WSJ). Earnings this year are expected to exceed $10billion.

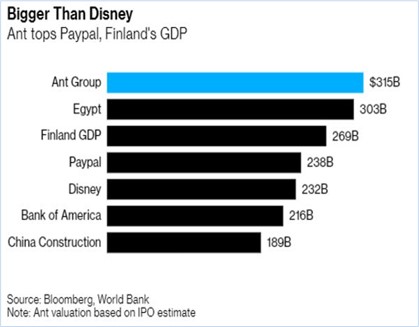

To put this in context, an IPO values Ant at approximately $315billion, or $15billion more that J P Morgan & Co (at today’s market price), the world’s most highly valued bank, established in 1871.

The origins of Ant go back to 2004, and the creation of an electronic payment processing system for Alibaba’s new trading platform. Ant was carved out of Alibaba into a separate entity in 2014 and today is the world’s most highly valued financial services company – all achieved in less than 20 years. Some other important facts and figures surrounding the IPO:

- The IPO was planned for Shanghai and Hong Kong only – typically a US market (Nasdaq) would have been included in order to ensure success of such a large equity event. Chinese companies can now be independent of US capital markets.

- The issue was reported as 870 times oversubscribed (Bloomberg) and described as a ‘frenzy’. Individual investors in Hong Kong were using up to 95% leverage to apply for the largest possible allocations.

- Jack Ma, the founder of Alibaba and Ant, was an English teacher in China when he founded Alibaba with $60,000. With an Ant IPO his estimated net worth would be $71billion (Bloomberg), and 18 other employees of Ant would become paper billionaires.

The shocking last-minute cancellation of the Ant Financial IPO sends some very important messages about investment in China:

- In spite of the huge gains China has made in its economic growth, financial regulation has lagged. Governance issues remain a real risk in Chinese companies, and this episode emphasises this fact. Whether the regulators changed the rules at the last minute, or Ant had failed to heed the draft guidelines is neither here nor there – the fact is China remains a relatively high risk investment environment from a governance perspective.

- The political overtones suggest that Ant was becoming too high profile and powerful. Jack Ma, the founder and Chairman, recently dared to criticise publicly the financial regulators in China and the established Chinese banking industry. As is clear, the CCP bears no criticism and Ant (and its shareholders) have paid the price. The message is very strong – the CCP is in control.

- The regulators used “financial stability” as the pretext for the actions on Ant. Stability in financial, social and political matters are the core to the CCP’s future plans for China and their own survival, suggesting even greater levels of government control in the future to ensure stability.

It is unclear at this stage whether the IPO will be relaunched in the near term or further out in the future, with a very different valuation and risk profile. However, this event does not derail China’s long-term goals. Indeed, President Xi re-iterated last week the goal to double the size of the economy by 2035. The Shanghai market actually rose in spite of the turmoil cause by the IPO cancellation. The long-term investment opportunity remains in place, but with higher governance and regulatory risk.

Why is this news so important?

Apart from the self-evident size of the IPO, this event highlights perhaps the most important long-term development for the world economy; that is, the coming of age of China as an economic (and political) powerhouse and empire builder. The much talked about “China Century” is now a reality, and one that the world and investors can no longer ignore. The sheer size and reach of China is now a defining factor in world economics – and politics. More relevant facts and figures:

- China has grown at break-neck speed for over 30 years, taking GDP from $360billion in 1990 to $14.3trillion in 2019. Some argue that it is already the largest economy on the planet on a PPP basis. For eg, vehicle production of 27million units in 2019 is now more than double that of the US, and up from 2million in 2000. The combined market cap of Chinese stock exchanges (including Hong Kong) is now greater than $15trillion (vs $30trillion in the US)

- GDP per capita has grown from $730 in 1990 to $8,254 in 2019 – but it is still a long way short of $55,809 in the US. China plans to be “stronger, richer and the world’s top innovator by 2035” with an annual GDP growth target of 5% until then.

- China has implemented the Belt and Road Initiative (BRI: https://www.beltroad-initiative.com/belt-and-road/) to create an economic and political empire through investment in, and control over, telecommunication systems and trade channels with its subscribers. Today 138 countries have signed up to BRI, which are estimated to cover more than 65% of the world’s population and include developed countries such as Italy, Austria and New Zealand. The project is set to continue this development up to 2049, the 100th anniversary pf the People’s Republic of China, and is written into the constitution.

- The Chinese currency, the Renminbi, (of which the yuan is a basic unit), is already a parallel trading currency to the USD within the BRI countries, to be expanded by a crypto version that will be run centrally by China and be backed by large gold reserves – and will bypass the USD.

- China is implementing a “dual circulation” economic strategy, which prioritises the importance of strengthening domestic demand and local technology development over closer integration with the outside world. China currently imports $300bn of semiconductors annually and aims to become self-sufficient by 2025.

- China’s economic recovery from the pandemic has been a “success”, showing positive GDP growth to date of 0.7%, and more than 3% expected for the year as a whole – the only major economic block expected to show growth for the year as a whole.

The lessons to be learnt

As the “old, democratic world” slides into ever greater debt, demographic headwinds and a C-19 (from China) driven economic torpor, China should continue to grow both domestically and on the back of its new empire, and without the shackles of domestic democratic interference. Control of communications and trading channels has been the backbone of economic empires since time began and is no different today. Companies based in and doing business with China will benefit from these economic developments, but at the cost of political acquiescence (see HSBC). Thus, global economic growth is likely to be increasingly dominated by China and its satellites, while the others will grow at (significantly) slower paces. Chinese equity markets are likely to reflect this in the longer term, while the mature economies’ equity markets are likely to reflect their lagging growth prospects.

The choice for investors

Given the likely economic growth differential between China and the other established large economic blocks (the US, Europe, Japan) over the next decade or more, investors face a conundrum. With the prospect of stronger economic growth come important downsides from investing in China:

- A political system that does not appeal to most Western sensibilities and helped generated the C-19 disaster

- The most polluting large country in the world (79.9/100 on one measure vs 38.2/100 for the US)

- The lowest country ESG score (according to Robeco) after, India, Venezuela and Nigeria

- The third lowest corporate ESG scores according to Morningstar, with only Russia and Qatar lower

The trade-off seems clear – do investors accept the downsides, including the very real risk of poor corporate governance and the unattractive social and environmental conditions that come with investing in China, in order to take advantage of the potentially higher investment returns on offer. Or not.

In conclusion

Investment in China cannot be avoided, in spite of political and ESG issues, if portfolio returns are to be acceptable over the next decade or more. But ESG considerations should apply to the selection of investments, with CAVEAT EMPTOR as a top consideration.

Key Family Partners SA is a multi-family office based in Geneva, Switzerland. We serve our members with investment services, financial planning, administration, succession planning, education and philanthropy. Contact us at KFP@keyfamilypartners.com ~ +41 22 339 00 00 ~ Rue François-Bonivard 6, 1201 Geneva. https://www.keyfamilypartners.com/. Member of European Network of Family Offices – ENFO

This article may contain confidential and proprietary information. Any unauthorised disclosure, copying, storage or use of this presentation may be unlawful. The content of this presentation does not constitute investment or financial advice and may not be relied upon as such. It does not constitute an offer or invitation for the sale or purchase of services or securities and shall not form the basis of any contract. Key Family Partners SA does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Key Family Partners SA is a private limited company with its registered office at Rue François-Bonivard 6, 1201 Geneva, registered with the commercial registry of Geneva under the IDE Nr. CH-395.573.747. KFP is a member of the Swiss Association of Asset Managers (SAAM).